In this post, i am going to describe how to transfer Purchase orders to a new fiscal year.

I am using COM data set here.

I am transferring the Purchase order created on Fiscal year 2014 to the next fiscal year 2015

Carry forward budget on the accounting date of 1/1/2015 with 100 expense amount is created because i created Purchase order of 100 and then ran Purchase order year end process for that Purchase order.

Original budget was fully consumed of the current fiscal year with the -100 expense amount in order to balance the expense budget amount of Carry forward budget with the Original budget. So, the net expense amount of sum of expense amounts of Carry forward budget and the Original budget will be zero as we have fully consumed the budget.

PO year end process closed out the current fiscal year Budget register entry on the accounting date 12/31/2014 which is a closing period and opened Carry forward budget register entry on the next fiscal year's first period on the accounting date 1/1/2015

Happy Daxing!

I am using COM data set here.

I am transferring the Purchase order created on Fiscal year 2014 to the next fiscal year 2015

Go to Accounts Payable > Common > Purchase Orders > All Purchase Orders

Click New > Purchase Order button on action pane

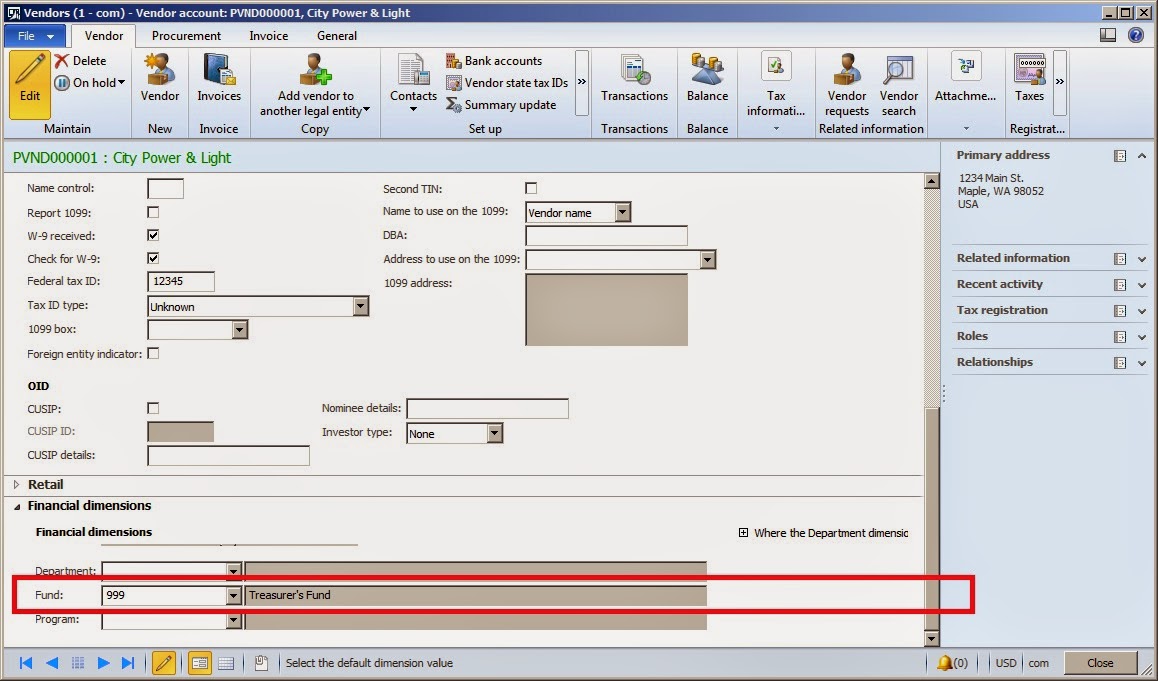

Set Vendor Account = PVND000001

Click Yes on AX message box

Click OK button

Click Add line button

Set Procurement Category = APPAREL AND LUGGAGE AND PERSONAL CARE PRODUCTS

Set Quantity = 1

Set Unit = Ea

Set Unit price = 10

Click Financials > Distribute amounts button

Set Ledger Account = 999-64500-120-101 [Set ledger dimension for which Budget Register Entries are already created. I will discuss Budget Register Entries in my next posts. This is the ledger dimension of Expense Account Structure as we are doing expense transaction (Purchase Order)]

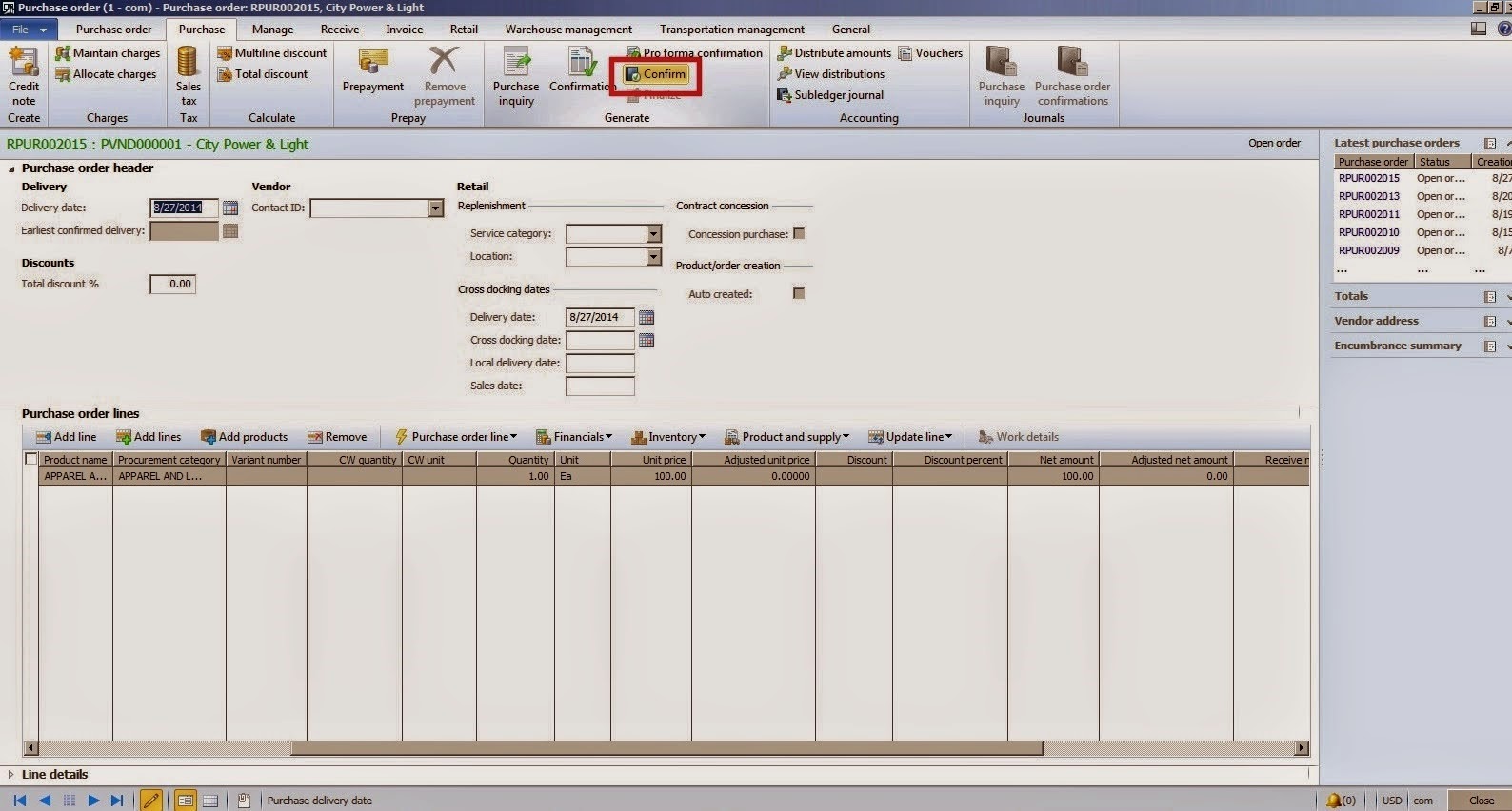

Click Purchase tab on the top

Click Confirm button under Generate section

Go to General Ledger > Periodic > Fiscal year close > Purchase order year -end process

Click Confirm button under Generate section

Users can select one of the two year -end options depending on their needs:

Process and carry forward budget

Process and do not carry forward budget

Process and carry forward budget:

Process and carry forward budget means that Purchase order is transferred to the next fiscal year as well as Carry forward budget is also created against that particular Purchase order.

Process and do not carry forward budget:

Process and carry forward budget means that Purchase order is transferred to the next fiscal year but no Carry forward budget will be created. So, in order to consume the budget against that particular Purchase order therefore user will have to create the Budget register entries separately otherwise Purchase order cannot be confirmed if Budget Control configuration is turned on and activated.

I am selecting Process and carry forward budget for now.

Set Fiscal year to 2014 as i have done Purchase order transaction on the fiscal year 2014 as stated above.

Accounting date is populated as 12/31/2014 because we are doing Purchase order year -end process to close the current year end Purchase order transaction and open that particular Purchase order transaction on the next year that's why Accounting date is populated as 1/1/2015. We cannot change these parameters as all Closing and Opening parameters are totally dependent on the Fiscal year set on Calendar parameter.

Click Retrieve purchase orders button

Click OK button

Select the Purchase order that was created above.

Click Process

Click OK

Click OK

An info log message as shown in the screenshot below should be displayed

You can see in the above screenshot that Budget register entries are also created for the next fiscal year as well as current year Budget register entries are also updated.

Source document Purchase Order is also linked to both the Carry forward budget register entries as well as Original budget register entries as Purchase order consumes the budget register entries.

Next year Carry forward budget screenshot:

Current year Original budget screenshot

Process and carry forward budget

Process and do not carry forward budget

Process and carry forward budget:

Process and carry forward budget means that Purchase order is transferred to the next fiscal year as well as Carry forward budget is also created against that particular Purchase order.

Process and do not carry forward budget:

Process and carry forward budget means that Purchase order is transferred to the next fiscal year but no Carry forward budget will be created. So, in order to consume the budget against that particular Purchase order therefore user will have to create the Budget register entries separately otherwise Purchase order cannot be confirmed if Budget Control configuration is turned on and activated.

I am selecting Process and carry forward budget for now.

Set Fiscal year to 2014 as i have done Purchase order transaction on the fiscal year 2014 as stated above.

Accounting date is populated as 12/31/2014 because we are doing Purchase order year -end process to close the current year end Purchase order transaction and open that particular Purchase order transaction on the next year that's why Accounting date is populated as 1/1/2015. We cannot change these parameters as all Closing and Opening parameters are totally dependent on the Fiscal year set on Calendar parameter.

Click Retrieve purchase orders button

Click OK button

Select the Purchase order that was created above.

Click Process

Click OK

Click OK

An info log message as shown in the screenshot below should be displayed

You can see in the above screenshot that Budget register entries are also created for the next fiscal year as well as current year Budget register entries are also updated.

Source document Purchase Order is also linked to both the Carry forward budget register entries as well as Original budget register entries as Purchase order consumes the budget register entries.

Next year Carry forward budget screenshot:

Current year Original budget screenshot

Carry forward budget on the accounting date of 1/1/2015 with 100 expense amount is created because i created Purchase order of 100 and then ran Purchase order year end process for that Purchase order.

Original budget was fully consumed of the current fiscal year with the -100 expense amount in order to balance the expense budget amount of Carry forward budget with the Original budget. So, the net expense amount of sum of expense amounts of Carry forward budget and the Original budget will be zero as we have fully consumed the budget.

PO year end process closed out the current fiscal year Budget register entry on the accounting date 12/31/2014 which is a closing period and opened Carry forward budget register entry on the next fiscal year's first period on the accounting date 1/1/2015

Happy Daxing!